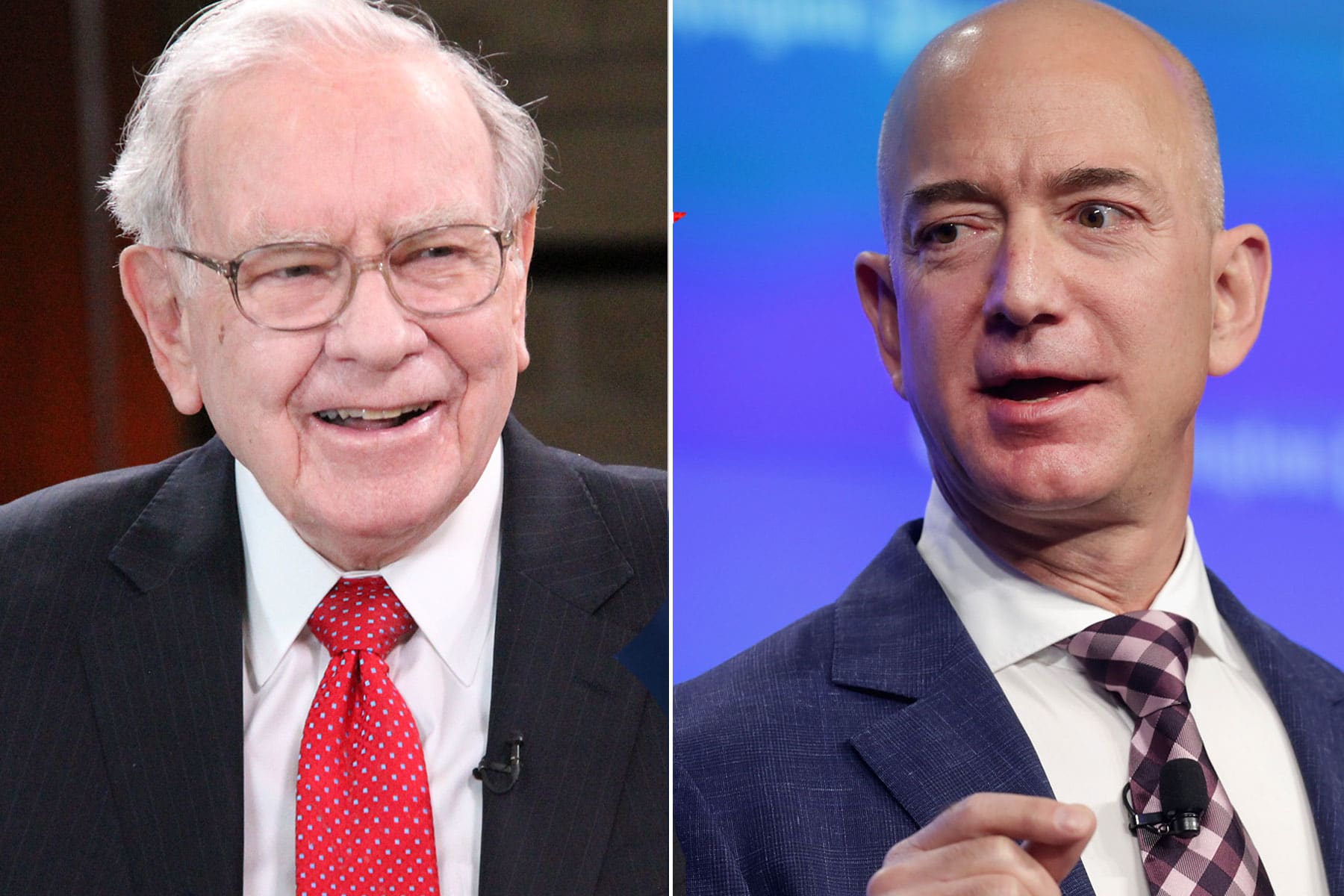

Bezos, Buffett, Bloomberg, Musk, Icahn and Soros pay tiny fraction of wealth in income taxes, report reveals

Some of the world's richest men — Jeff Bezos, Elon Musk, Warren Buffett, Carl Icahn, Michael Bloomberg and George Soros — pay just a tiny fraction of their increasing wealth in taxes, and in some cases pay no taxes in a given year, according to a report Tuesday.

ProPublica, citing confidential IRS data it obtained on thousands of wealthy people, reported that the 25 richest Americans "saw their worth rise a collective $401 billion from 2014 to 2018."

But those people paid a total of just $13.6 billion in federal income taxes for those five years, which "amounts to a true tax rate of only 3.4%," the article noted.

In contrast, the median U.S. household in recent years earned around $70,000 annually and paid 14% of that in federal taxes. Couples in the highest income tax rate bracket paid a rate of 37% on earnings higher than $628,300, the report said.

ProPublica pointed out that billionaires, unlike most other people whose earnings come from conventional wage income, often benefit from "tax-avoidance strategies beyond the reach of ordinary people."

And their wealth is often largely based on the rising value of stock and real estate that is not considered taxable unless those assets are sold, the report noted.

ProPublica did not disclose how it obtained the tax information cited in the article, but did say that the outlet "went to considerable lengths to confirm that the information sent to us is accurate." CNBC has not independently verified the information in the report.

The article said that according to ProPublica's calculations, Buffett's "true tax rate" was just 0.1%, or $23.7 million in taxes he paid on wealth growth of $24.3 billion, during the five-year time frame.

During that period, Buffett, CEO of Berkshire Hathaway, reported legally taxable income of $125 million.

Bezos, who as founder of Amazon has become the world's richest person, paid slightly less than 1% in ProPublica's true tax rate, or $973 million, on wealth growth of $99 billion during the five-year period. Bezos' actual taxable income during that time was $4.22 billion, the report said.

In 2007, Bezos "did not pay a penny in federal income taxes," and he also avoided any federal income tax liability in 2011, the article said.

The world's second-richest person, Tesla CEO Elon Musk, paid a 3.27% true tax rate, or $455 million, on wealth growth of $13.9 billion, ProPublica said.

Musk, who had an actual taxable income of $1.52 billion during the five-year period, paid no federal income taxes in 2018, according to ProPublica.

Bloomberg, former New York City mayor and founder of Bloomberg LP, paid a 1.3% true tax rate, or $292 million, during the time period looked at by ProPublica. His actual taxable income was $10 billion, the report said.

Soros, an investor, paid no federal income taxes between 2016 and 2018, which was a result of him losing money on his investments, his spokesman told ProPublica.

Icahn, another investor, paid no federal income tax in 2016 and 2017, years in which his total adjusted gross income was $544 million, the article said.

Icahn told ProPublica that he registered tax losses in both of those years as a result of taking deductions worth hundreds of millions of dollars due to the interest he paid on loans.

Asked whether it was appropriate that he had paid no income tax in certain years, Icahn said he was perplexed by the question, ProPublica reported.

"There's a reason it's called income tax," Icahn was quoted as saying in the article. "The reason is if, if you're a poor person, a rich person, if you are Apple — if you have no income, you don't pay taxes."

He added: "Do you think a rich person should pay taxes no matter what? I don't think it's germane. How can you ask me that question?"

White House spokeswoman Jen Psaki on Tuesday was asked about the leak of tax information to Pro Publica.

"Any unauthorized disclosure of confidential government information by a person with access is illegal, and we take this very seriously," Psaki told reporters at a news conference.

"The IRS commissioner said today that they are taking all appropriate measures, including referring the matter to investigators and Treasury and the IRS are referring the matter to the office of the inspector general, the Treasury inspector general for tax administration, the FBI and the US attorney's office for the District of Columbia, all of whom have independent authority to investigate

"So obviously, we take it very seriously," she added.

Psaki also said that she would not comment on the specific data in the article, but also said, "Broadly speaking, we know that there is more to be done to ensure that corporations and individuals at the highest income are paying more of their fair share."

Read the full ProPublica report here.

Source

Check Our More

No comments