There's a 'huge amount of money' returning to China in the IPO space, investor says

SINGAPORE — As tensions mount between Washington and Beijing ahead of the U.S. presidential elections in November, Stonehorn Global Partners' Sam Le Cornu sees more Chinese firms returning home.

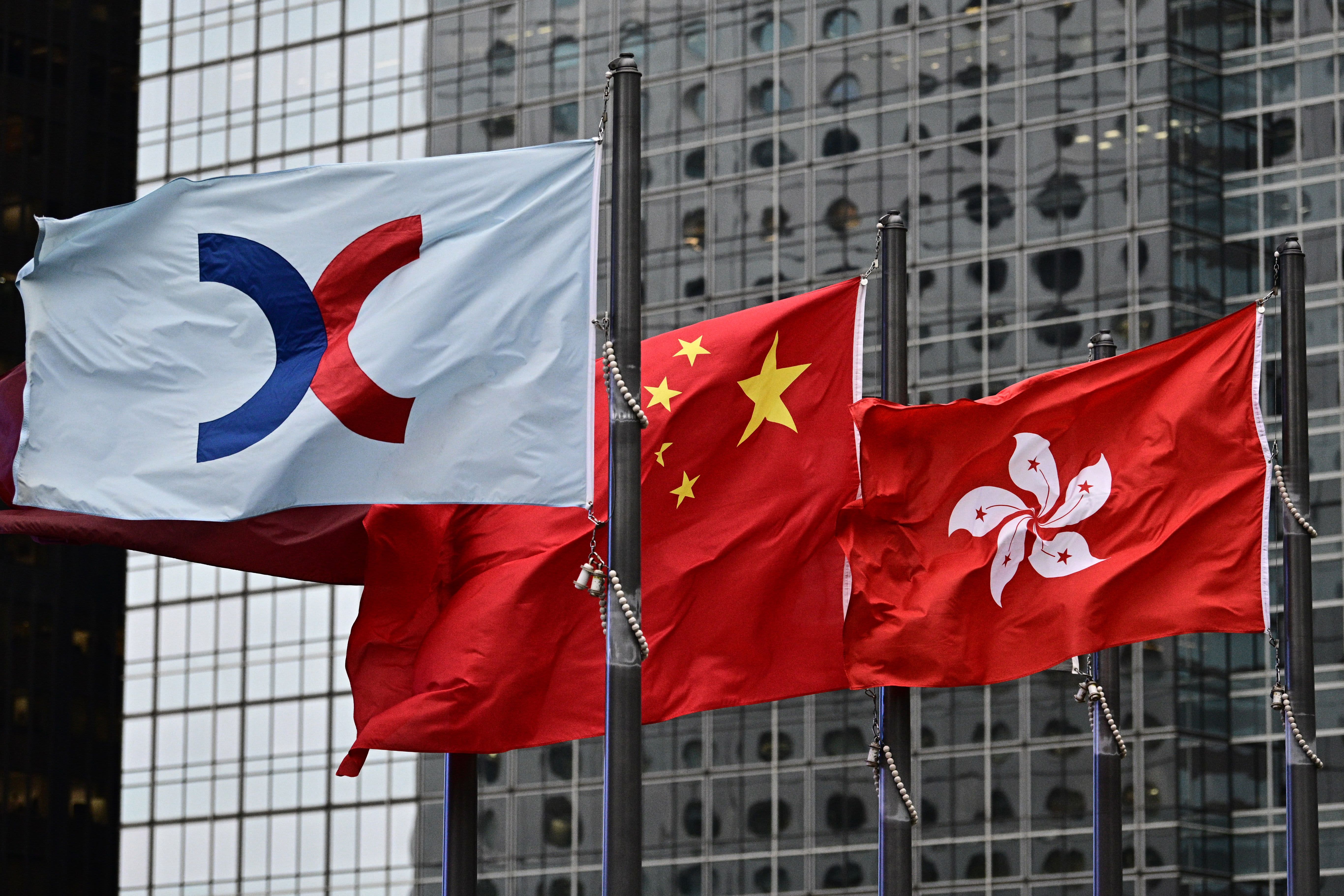

"There's a huge amount of money coming back home in terms of the IPO space," Le Cornu, who is CEO & co-founder of the firm, told CNBC's "Squawk Box Asia" on Monday.

That comes as U.S. President Donald Trump's rhetoric "is getting harsher and harsher" ahead of the election, he said.

On Monday, Hong Kong-listed shares of China's largest chip manufacturer Semiconductor Manufacturing International Corporation (SMIC) plunged more then 20% following reports that the Trump administration is considering imposing export restrictions on the firm.

Le Cornu sees potential investment opportunities in this environment, telling CNBC that the return of Chinese firms is "a huge shot in the arm" in terms of positive sentiment for the Hong Kong stock exchange as well as brokers such as China International Capital Corporation that have been "getting in" on the IPOs in roles such as underwriting.

"There's money to be made when looking at this activity," he said, adding that it's "not one-way in terms of negative sentiment."

For his part, Le Cornu said his firm is positioned for more listings in Shanghai and Shenzhen on the mainland as well as Hong Kong.

"I think the second half of the year will see an increase ... in these IPOs," the investor said.

Major firms that have found their way back to China through secondary listings on the Hong Kong stock exchange, following listings in the U.S., include: Alibaba, JD.com as well as NetEase.

"The trend is more companies coming home," Le Cornu said, adding that he expects "a lot more" to follow in the footsteps of JD.com and Alibaba in returning to list in China.

'Big' but 'good' changes to Hang Seng index

On Monday, tech companies like Alibaba and Xiaomi replaced firms such as Sino Land and Want Want in Hong Kong's Hang Seng index. Le Cornu described the tweaks as "big" but "good."

"It certainly changes (the Hang Seng index) from being very much financial heavy," he said. Pointing to Xiaomi's index weighting of about 2.6%, Le Cornu said that "puts it ahead" of Bank of China and just behind Industrial and Commercial Bank of China.

"The Hang Seng index has been traditionally ... old economy and bank heavy, the investor said. "This will certainly be interesting in terms of the HSI changes."

Source

Check Our More

No comments