Stocks making the biggest moves in the premarket: Alibaba, Estee Lauder, CureVac, Nvidia & more

Take a look at some of the biggest movers in the premarket:

Alibaba (BABA) – The China-based e-commerce giant reported better-than-expected profit and revenue for its fiscal first quarter, helped by a pandemic-related boost in online shopping. Alibaba had 874 mobile monthly active users in June, up 28 million from March.

BJ's Wholesale Club (BJ) – The warehouse retailer beat estimates by 17 cents a share, with quarterly profit of 77 cents per share. Revenue also came in above estimates. Comparable-store sales excluding fuel rose 24.2%, well above the 15.5% increase predicted by analysts polled by FactSet.

Estee Lauder (EL) – The cosmetics company lost 53 cents per share for its latest quarter, wider than the 19 cents a share loss anticipated by Wall Street analysts. Revenue was essentially in line with forecasts. Estee Lauder said it launching a two-year initiative to rebalance its investments, which will include a reduction in its retail footprint and increased emphasis on digital sales. It also plans to cut up to 2,000 jobs globally.

CureVac (CVAC) – The German biotech firm is in advanced talks with the European Commission to supply at least 225 million doses of a potential Covid-19 vaccine to European Union states.

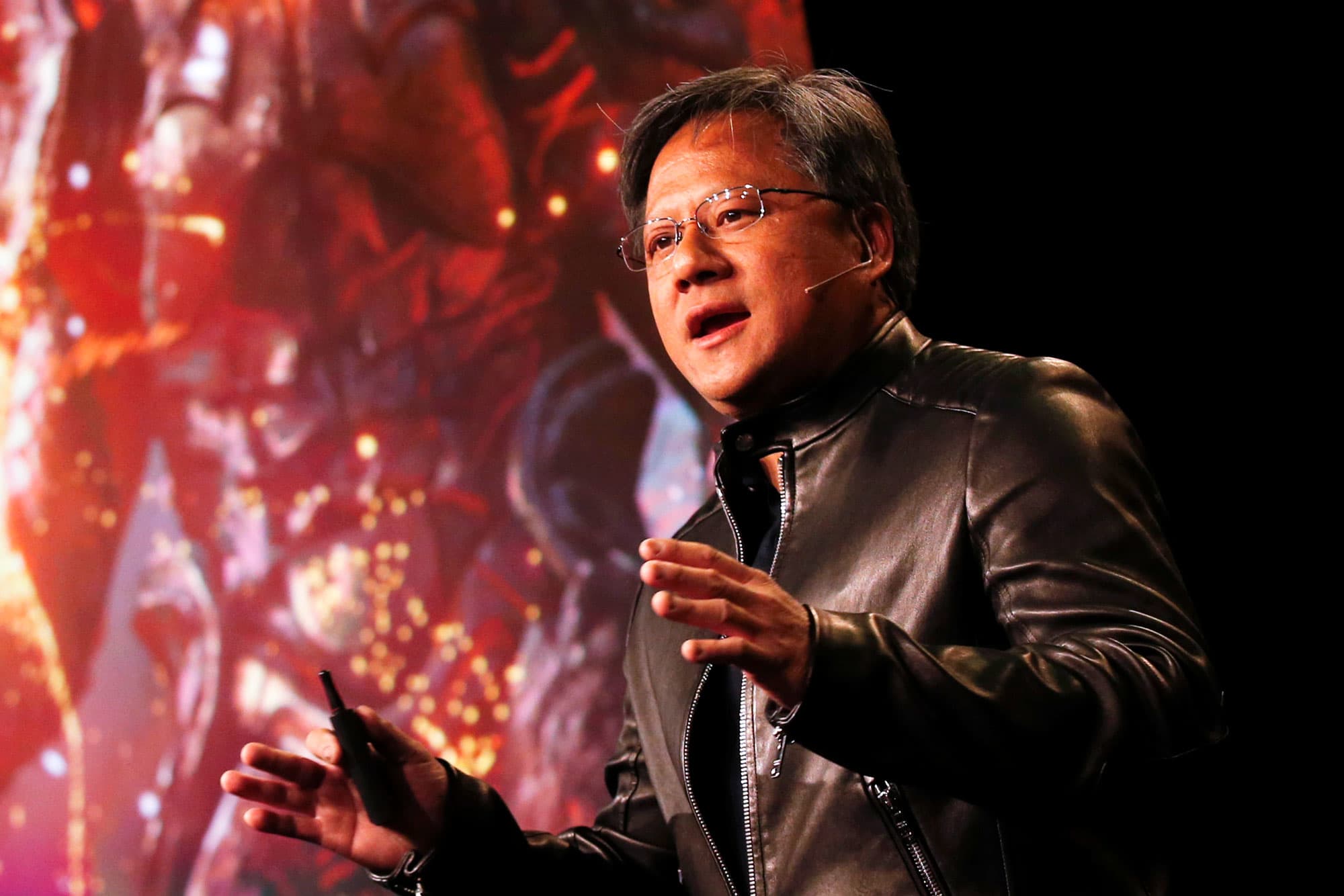

Nvidia (NVDA) – Nvidia reported quarterly earnings of $2.18 per share, beating the consensus estimate of $1.97 a share. The chipmaker's revenue also came in above forecasts. Nvidia also issued a strong current-quarter revenue outlook, but some investors were disappointed with the performance of Nvidia's data center business.

Intel (INTC) – Intel announced an accelerated $10 billion stock buyback program, with CEO Bob Swan saying the shares were trading "well below our intrinsic valuation." Intel's shares have been under pressure since the company said it was about a year behind on a shift to next-generation 7 nanometer production technology.

Nio (NIO) – Nio launched a new battery leasing service for electric vehicle owners. The China-based company's "battery as a service" offering would let drivers buy an electric vehicle without owning the battery pack, one of its most expensive components, and lower the price of its vehicles.

InterContinental Hotels (IHG) – French hotel operator Accor explored a potential merger with the British hotel company, according to a report on the Le Figaro newspaper. The report said Accor's board favored such a move, but that no contact had actually been made with IHG.

Facebook (FB) – Facebook won preliminary approval to settle a lawsuit that claims it illegally collected facial recognition and other biometric data from users. Facebook had offered in July to pay $650 million to settle the suit, up $100 million from a prior offer.

Xilinx (XLNX) – Xilinx and Japanese automaker Subaru struck a deal that will see the chipmaker supply semiconductors for Subaru's new driver assistance system. The so-called "Zynq" chip will debut in Subaru's upcoming Levorg midsized hatchback.

Chevron (CVX), General Electric (GE), Baker Hughes (BKR), Honeywell (HON) – The companies signed agreements with the Iraq government worth as much as $8 billion, designed to help Iraq's energy industry. The announcement comes ahead of Iraqi Prime Minister Mustafa al-Kadhimi's first-ever visit to the White House today.

L Brands (LB) – L Brands reported a surprise quarterly profit, despite the temporary closure of stores due to the pandemic. Strong sales of sanitizers and soaps helped boost results at the company's Bath & Body Works business, while Victoria's Secret saw a 28% jump In online sales.

Synopsys (SNPS) – Synopsys reported quarterly profit of $1.51 per share, beating the consensus estimate of $1.35 a share. The semiconductor design company's revenue also came in well above forecasts as well and Synopsys gave an upbeat full-year forecast amid strength in all its product groups.

International Game Technology (IGT) – International Game Technology signed a long-term agreement to provide sports betting technology to casino operator Boyd Gaming (BYD). The agreement will provide IGT's sports betting platform to Boyd's sportsbooks in Nevada, as well as its mobile and online sports betting apps.

Source

Check Our More

No comments