Hong Kong's new tech index up 3.5% on the second day of trade

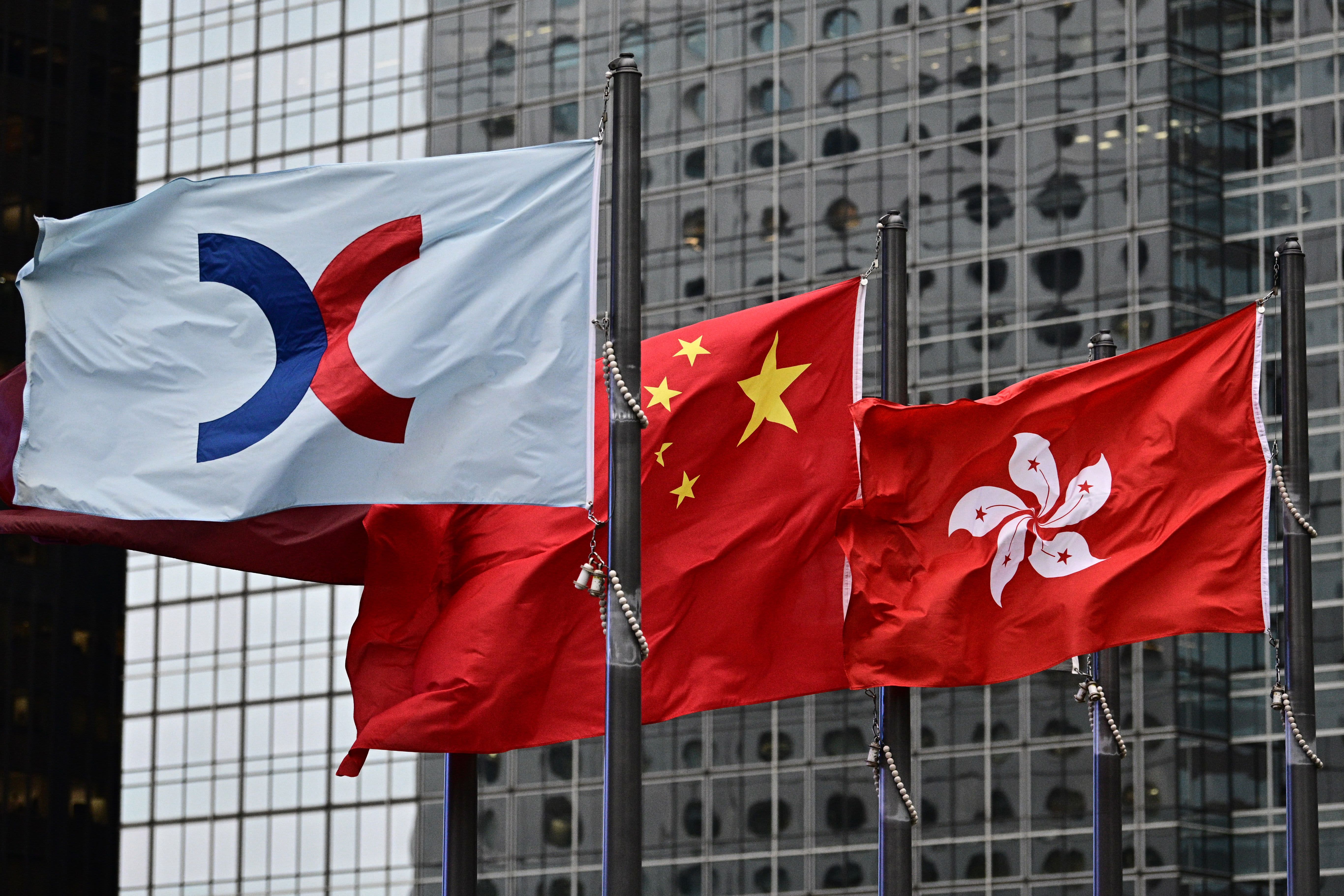

From left, the flags of the Hong Kong Stock Exchange, China and Hong Kong are seen flapping in the wind on May 6, 2019.

Anthony Wallace | AFP | Getty Images

Hong Kong's new tech index rose on its second day of trading as experts said its diverse list of constituents will be attractive for traders looking to invest across the sector.

The Hang Seng Tech Index rose 3.51%, beating the broader Hang Seng index which traded up 0.69%.

"It's a really good, I think, list of constituents across multiple slices of the tech sector," said Sam Le Cornu, CEO and co-founder of Stonehorn Global Partners.

The tech index was launched on Monday and tracks the 30 largest technology companies listed in Hong Kong that pass the screening criteria.

Tech shares are some of the top traded stocks in Hong Kong. The new index trades at about 45 times earnings, versus the Hang Seng Composite Index's price-to-earnings ratio of 12, according to data published by Hang Seng Indexes Company before the new index's first day of trading.

The top five firms listed on the index are Alibaba, Tencent, Meituan Dianping, Xiaomi and Sunny Optical, which had a combined weight of more than 40% as of July 17. Others include Ali Health, JD.com, Lenovo, Ping An Good Doctor and ZTE.

"So, it's not just hardware, you've also got some insurance in there, you've got some cloud computing, you've got fintech, e-commerce, you have got a really nice slice. The only thing it doesn't have, I think, is renewable tech. So, it doesn't have batteries in there," Le Cornu said on CNBC's "Squawk Box Asia" on Tuesday.

"Apart from that, it's a really interesting tech index and I think it will be one which would be followed very closely," he added.

Analysts at Citi said interest in the new index may draw some attention away from the tech-heavy Nasdaq in the U.S. and could lead to more turnover at the stock market operator, Hong Kong Exchanges and Clearing, with "more related index linked products" that could be issued.

The index's constituents will be reviewed quarterly and a fast-entry rule could allow significant tech companies that go public in Hong Kong to be included if they meet certain requirements. That implies when fintech giant and Alibaba affiliate Ant Group goes public, it could potentially be added to the index.

Ant Group is preparing a dual listing in Hong Kong as well as on the Shanghai Stock Exchange's tech-focused STAR board. Though details on the pricing of shares are not yet available, some analysts are predicting a mammoth valuation that could top that of some of Wall Street's biggest banks.

Le Cornu pointed out that alongside Ant Group, other U.S.-listed Chinese tech companies that may either return to Hong Kong or do secondary listings there could also potentially be added to the index under the fast-entry rule.

Rising U.S.-China tensions have prompted some Chinese companies listed on Wall Street to return to Hong Kong. For example, the likes of Alibaba, JD.com and NetEase have carried out secondary listings there. More could follow if a U.S. bill that may force Chinese companies to delist from U.S. stock exchanges is passed.

Jonathan Garner, managing director and chief Asia and emerging market equity strategist at Morgan Stanley, said the new tech index is important.

"When we actually look at the development of the markets here, those intra-regional flows, particularly the north and south bound channels in and out of China are very important for the future evolution of the markets here," he said on CNBC's "Squawk Box Asia" on Tuesday.

Garner added that while the American depositary receipt (ADR) market, which is used by Chinese companies to list and trade in the U.S., is likely to diminish in relevance, these new indices are "clearly offering a product suite that is going to be part of the market's development out here in Asia."

Source

Check Our More

No comments